Income Tax (ITR) Filing Service

Save money, Save time.

We at VCS Wealth provide expert CA-assisted ITR filing for Individuals & companies. Get a dedicated tax expert to handle everything, from start to finish.

- Get Instant Audit Report

- Upload Your Documents

- File Return

Trusted by 5K+ ⭐ Active users

WHO CAN FILE INCOME TAX

Expert assisted ITR filing process

Live Filing

File your Income Tax return with Tax Experts on Live. Claim your tax benefits under Section 80C and other applicable sections

Salaried Income

File your Income Tax return with Tax Experts. Claim your tax benefits under Section 80C and other applicable sections

Capital Gain

Having Capital Gains from the sale of property, Shares/Mutual Funds, or need to claim tax relief under Section 89?

Foreign Income

Tax Filing Simplified for Indian residents with foreign income. Get your tax filed by VCS Wealth Experts

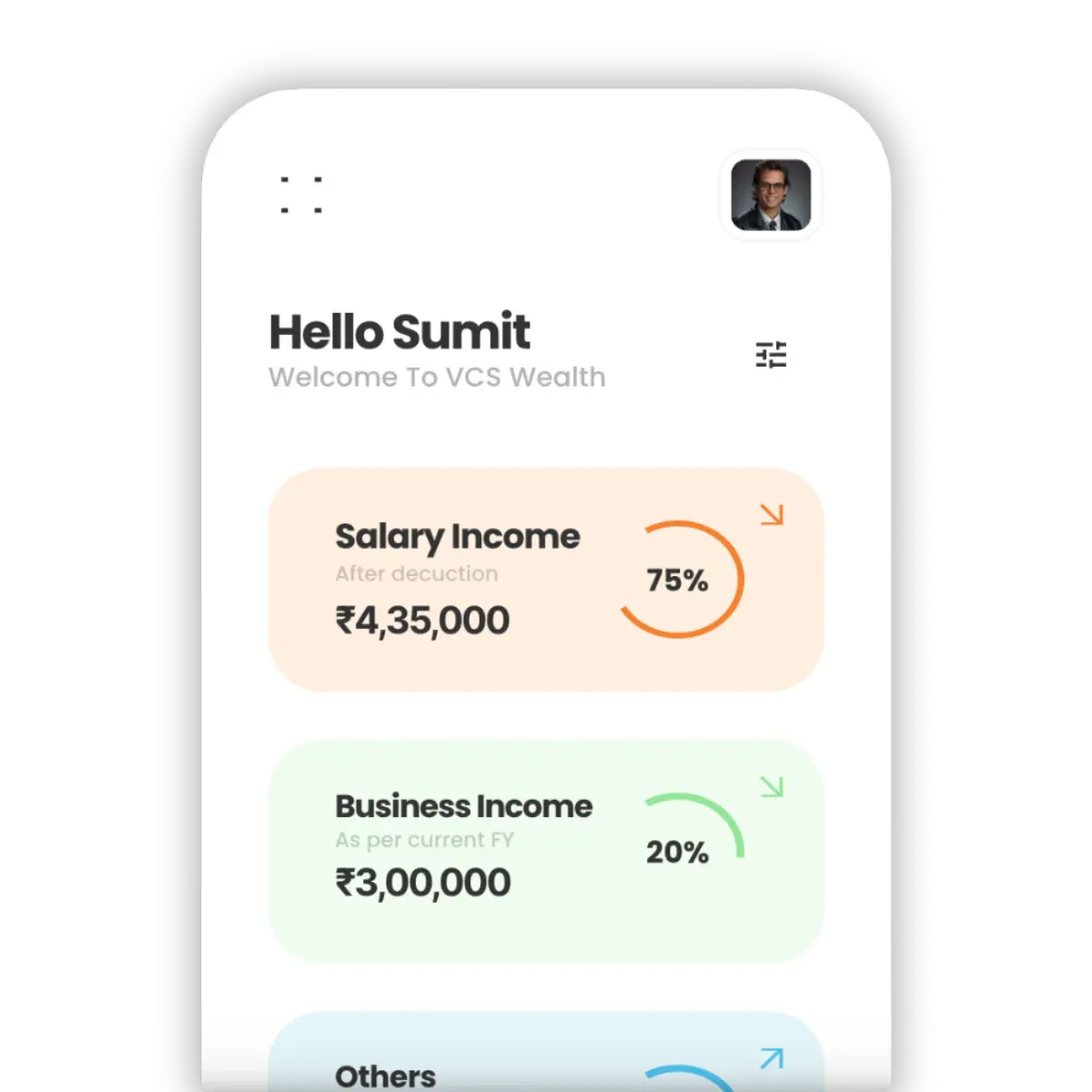

SKIP THE COMPLEX PROCESS

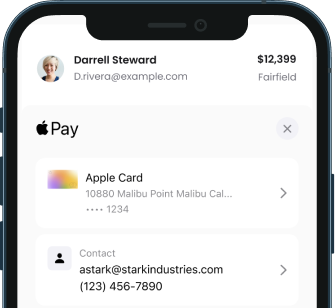

All your financials at one place

It is a long established fact that a reader will be distracted by there readable content of a page when looking at its layout point .

- Audit your income from experts before filing

- Save upto 1.5 Lakhs tax every financial year

Who can file Income Tax Returns ITR?

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

Revised ITR

For tax filers who have already filed for FY 2023-24, but seek to edit and file a revised return.

Belated ITR

For taxpayers who missed the filing deadline of 31st July. Do easy filing of your Belated ITR

Salaried

For taxpayers with salary income from single/multiple sources. Upload Form 16 or enter the details manually.

Self Employeed

For freelancers, doctors, lawyers, engineers, designers, photographers, consultants and other professionals

Foreign Income

For Individuals with Foreign Income, Foreign Assets, or NRI or RNOR (Resident-Not-Ordinarily-Resident)

Stocks, Crypto

For taxpayers with Capital Gains from investments in Stocks, Mutual Funds, F&O, Crypto / VDA assets, etc.

Connect LIVE with our income tax advisor

Connect with our income tax advisor on a video call from the comfort of your home and file your ITR before the due date.

Company

Disclaimer: Investments in securities/Mutual funds are subject to market risks. Please read the scheme information and other related documents carefully before investing. Consult your financial adviser before making any decision. Registration granted by SEBI, membership of AMFI, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors. Past performance is not indicative of future returns. Portfolio returns and allocation between equity and debt are estimated based on a number of factors including the user’s risk profile, goal horizon and disclosed financial position. The performance of any investment portfolio can neither be predicted nor guaranteed.